NJHMFA Down Payment Assistance

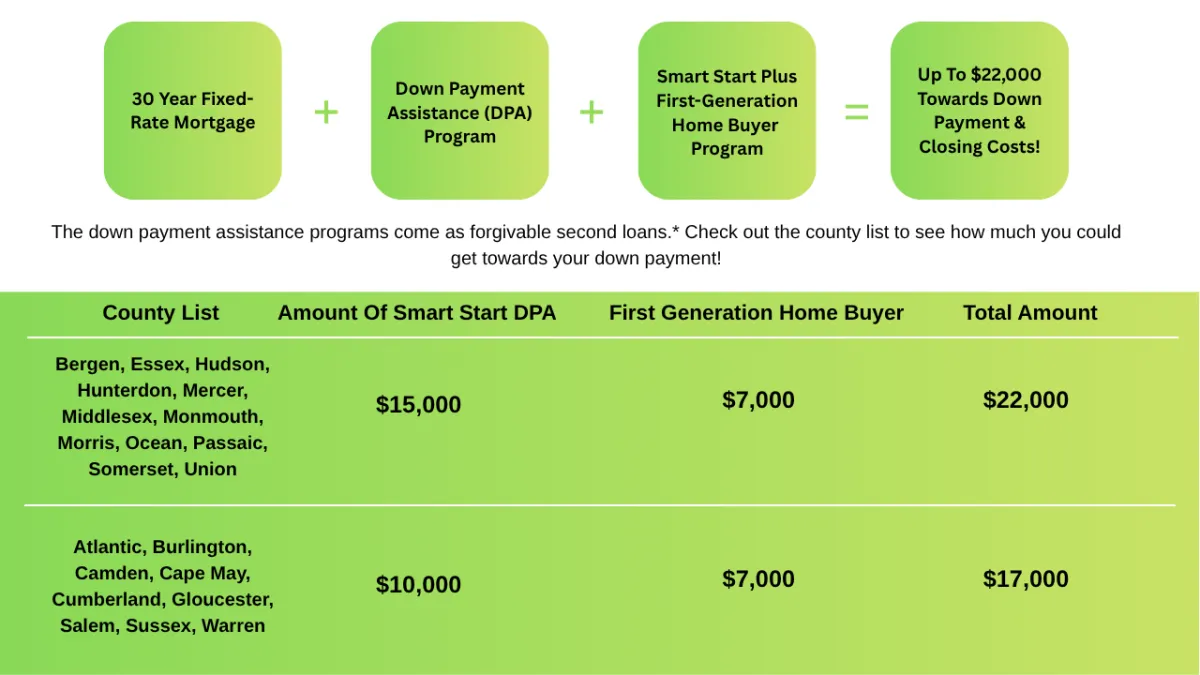

UP TO $22,000 TOWARD YOUR DOWN PAYMENT AND CLOSING COST

Wishing you could buy your first home? Between interest rates, home prices, and down payments, it’s a costly venture that not everyone can afford. It can be especially hard for first-generation home buyers. But New Jersey Housing and Mortgage Finance (NJHMFA) have a program that can help.

What is a first-generation home buyer?

Template staging streamlines your mortgage journey, providing clear, customizable steps from application to approval. With structured guidance and personalized options, it ensures a smooth process for confident, informed decisions. Get ready for a hassle-free path to the perfect mortgage fit.

Streamlined Application Process: Templates simplify each step, making it easy to progress from application to approval.

Personalized Loan Options: Customize your loan experience with staging that highlights the best choices for your financial needs.

Clear, Transparent Guidance: Templates are designed to offer clear information, eliminating confusion and promoting informed decisions

Enhanced Customer Experience: A staged journey ensures that you’re fully supported from the initial inquiry to loan closing.

Focused on Approval Success: Each template is structured to maximize your likelihood of loan..

HOW NJHMFA HELPS YOU

*Loan is forgiven over a period of 5 years, as long as the borrower remains in property as their primary residence. If home is sold, transferred, or no longer is borrower’s primary residence, the unforgiven funds will become due and payable.

Testimonials

ABSOLUTE PLEASURE

Sean was an absolute pleasure to work with! Being a first-time home buyer comes with many questions and times of uncertainty throughout the process. Sean made this so seamless for us, answered all of our questions at anytime, and communicated all the details needed for us to be informed. We honestly don’t know if we would’ve done this without him! Thank you Sean for your hard work and dedication throughout this process!

Jesenia P.

Testimonial Tree Review (May. 2025)

FRIEND FOR LIFE

Sean was nothing less than perfect. He was very patient, informative, and understanding to any questions I had asked. Anytime I needed answers, he explained the process thoroughly. As a first-time home buyer I couldn’t ask for a better experience. He not only keeps you in the loop with every step in the process, but he also shows that he really cares while always keeping your best interest in mind. I’ve not only got a new home, but I’ve made a friend for life!!

Kevin

Google Review (April. 2025)

REVIEW LONG OVERDUE

This review is long overdue! We met Sean in June of 2024 at an open house. We already had a loan office we were working with but we wanted to explore other options and I’m so happy that we did. We had been looking for our forever home for about 2 years at that point with no luck. Sean had great energy from the day we met him till closing and even after! We were pre-approved in less than a week and the hunt continued.

Jesenia P.

Testimonial Tree Review (May. 2025)

Sean Kenny

Loan Officer - NMLS ID# 593206

80 E State Rt 4, Suite 370,

Paramus, NJ 07652

Home | Contact | Blog | Web Accessibility | Privacy Policy | Terms